Abstract

In today's volatile, uncertain, complex, and ambiguous (VUCA) environment, organizations face unprecedented challenges in keeping pace with technological advancements while meeting dynamic market needs. This paper introduces a strategic model called "The Merge", a visual and conceptual framework to help organizations understand where they sit in relation to innovation adoption, and more importantly, how they can position themselves to lead rather than follow. This paper is intended for business leaders, strategists, investors, and policymakers looking to optimize their timing, resource allocation, and strategic posture in a rapidly evolving global landscape.

1. Introduction

Technological disruption is not a question of "if," but "when." Success depends not only on innovation or operational excellence, but on the timing of both. Many organizations struggle with how to strategically position themselves along the innovation curve. "The Merge" offers a model for understanding that curve and developing a roadmap to either shape or respond to it.

2. The Merge Explained

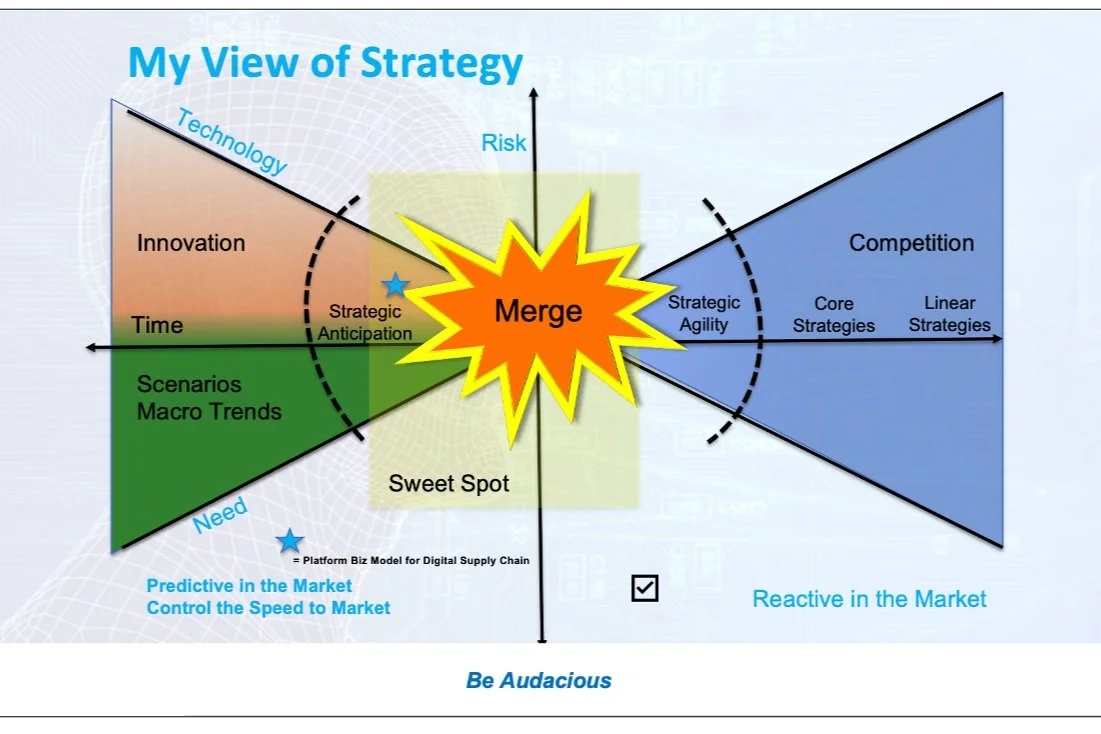

At the center of the model is The Merge, the moment when an emerging technology intersects with a validated need, giving birth to a new market. This convergence of innovation and demand is the most critical point in any market lifecycle.

Surrounding The Merge are three primary strategic zones:

Left of the Merge: The space of high risk and high reward. Here, innovators operate with foresight rather than hindsight. Startups often live here; incumbent firms typically struggle to operate in this zone without external acquisition or skunkworks projects. The role of Strategic Anticipation is essential.

The Merge Zone (Sweet Spot): This is where domain expertise, anticipation of mega-trends, and agility come together. Companies here don't just enter markets early, they shape them. This zone represents an optimal blend of insight, resources, and execution.

Right of the Merge: The domain of risk-averse organizations. Strategy here is based on historical performance, core competencies, and incremental improvement. These companies often compete in maturing or declining markets and risk irrelevance in emerging ones.

3. Strategic Implications for Organizations

Operating Left of the Merge requires:

- A culture that embraces failure as learning

- Deep domain expertise combined with visionary leadership

- Resource commitment before ROI is guaranteed

- Structural insulation from bureaucratic drag (often via incubators or M&A)

Operating in the Sweet Spot demands:

- Strategic agility: The ability to pivot rapidly and deploy capital effectively

- Strong capability in scenario planning and trend analysis

- Ability to identify and recruit top talent for innovation initiatives

- Empowerment of internal champions with a voice in executive leadership

Operating Right of the Merge requires:

- Focus on defensible market share

- Efficiency in operations, supply chain, and cost management

- Realistic view of limits on future growth from within current markets

4. Case Studies in Merge Positioning

Apple and the iPhone: Prior to 2007, no market demanded a smartphone with the breadth of features the iPhone delivered. Apple created the need and filled it simultaneously, defining a new market and displacing dozens of discrete technologies.

Facebook and Oculus Rift: With its acquisition, Meta jumped to the left of the merge in VR, gaining early influence over a developing market.

Boeing and Aurora Flight Sciences: Boeing positioned itself for a future of unmanned flight by acquiring Aurora, securing both talent and technology ahead of broad adoption.

GE Digital Transformation: GE's attempt to pivot from industrial to digital highlights the challenges faced by large incumbents seeking to reposition in the sweet spot without clear internal structure or culture alignment.

5. How to Shift Left

Organizations can move left of the merge by:

- Creating autonomous innovation hubs

- Linking R&D more tightly to strategy

- Engaging in early-stage venture investments or strategic partnerships

- Prioritizing talent acquisition in emerging domains

- Allowing room for unproven ideas to breathe, fail, and iterate

Most critically, they must resist the gravitational pull of quarterly earnings pressure and short-termism that often steers them right of the merge.

6. Conclusion

"The Merge" is more than a conceptual framework; it is a strategic lens for leaders who want to understand the forces shaping their industries before those forces reshape them. Market leadership is rarely won through reaction…it is claimed through vision, risk tolerance, and audacity.

The future is being built left of the merge. The question is: Will you create it, or chase it?